Almost everyone knows that personal financing is one of the popular choices among Malaysians to finance for their home and vehicle purchase deposit. This can be proven based on social media and acquaintances who shared that they use personal finance money to get married, help parents, home improvement or to start a business. It has become a trend when it comes to getting small and fast approval funding.

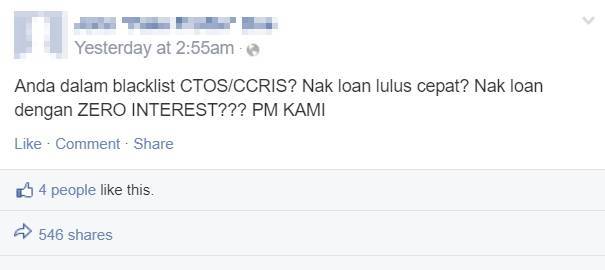

The problem with this is that there are some loan agents/officers who are taking advantage of those who are in desperate need of money by making an unreasonable offer, giving false info and so on. You can see a lot of personal financing advertisements on Facebook that do not make sense targeted at those who are desperate and want fast financing.

So, to prevent many people from becoming victims of personal financing fraud, we have tips that you can use when you want to apply for personal financing.

Contents

1. Do not be fooled by unreasonable offers

To attract borrowers, some companies offer ‘attractive’ deals such as interest-free financing or lower-interest financing which sounds way better than the benefits offered by the private finance companies and conventional banks.

Even worse, some also offer personal financing to CTOS or CCRIS blacklisted borrowers! For your information, if you are blacklisted by CTOS or CCRIS, no licensed bank or loan company will approve your personal financing application. Who wants to provide financing to those who have problems with repayment anyway? Even if they do, it will come at a high price.

For example, a personal financing application from YIR will NOT be approved if you have an outstanding credit balance of more than RM45,000 or those who are blacklisted on CTOS or CCRIS.

READ: Everything You Need to Know About CTOS and CCRIS

These are some of the tactics that are widely used among personal finance frauds and if you find yourself struggling to obtain financing from the conventional banks, it’s advisable to avoid applying for personal financing from any suspicious companies, as you are at risk of being deceived.

2. Do not forget to do your own due diligence

Before applying for personal financing, we advise you to do some research about the type of personal financing that you need and the options available out there. All you have to do is to surf the net and ask your friends or family members who have made the loan that you want. If you need more accurate information, contact the company directly to avoid misunderstanding and not get caught up with the agents/officers’ sweet-talking.

Some of the things that you need to know are like loan eligibility, interest rates, repayment terms, required documents and funding approval periods.

3. Please make sure of the amount of financing that is required

As a borrower, the most important thing to make sure is the amount of funding required to avoid any problems in the future such as long repayment terms with mind-boggling interest rates!

You need to calculate and review the Debt Service Ratio (DSR) on the number n of deductions in the payroll statement after deducting the total revenue. It’s a set of rules for government employees and statutory bodies to make sure that your DSR is within 50 – 60%.

Some agents/officers will try to persuade you to get the maximum amount of funding. For example, if you want to apply for RM10,000 personal financing and you are offered a maximum of RM13,000, you can still opt to apply for RM10,000. Avoid being influenced by their persuasive plea and always refer back to the Product Disclosure Sheet (PDS) and FAQ to prevent yourself from getting stuck with unnecessary financing predicament.

For instance, if you’re applying personal financing from YIR or YYP via its agent/officer and he/she is making such suggestion, do refer back to the refer PDS for both YIR and YYP and their FAQs so that you’re more well informed. Such information is publicly available via their website.

4. Understand and pay close attention to the loan application process

Once you are satisfied with the amount offered and having gone through PDS, the agent/officer will send your application to a personal financing company for review. Take note that there might be other charges like processing fees which some agents/officers do not share, so this is something that you have to ask and be aware when applying through an agent/officer.

Other charges include processing fees (cost of the application process) and stamp duty (payment to Inland Revenue Board of Malaysia (IRBM)). Both of these charges are dependent on the personal financing companies and not all impose these charges.

On the other hand, some agents/officers will insist for upfront payment, known as “processing fees”. Be careful, authorized agents/officers will not require borrowers to pay any upfront payment. The processing fees are deducted from the loan amount before disbursement.

So carefully read every document and PDS provided by the company or agent and go through the processes such as credit research, employer and customer verification. Make sure the information provided by the personal financing company is true and valid to prevent your personal financing application being denied.

5. Avoid borrowing from an unlicensed personal agent or financing company

Kebanyakan mangsa penipuan pembiayaan peribadi didapati tidak memeriksa status ejen/pegawai yang didakwa memberikan. More often than not, most people fall for personal financing fraud because they do not check the status of the company allegedly providing personal loan services. To avoid the same thing happening to you, you should check the status of the personal financing company of your choice.

It’s important that the agent/officer contacting you for personal financing claims to be the agent/officer of the financing company. Contact the company through the registered telephone number on the website and ask whether the personal financing company has appointed an agent/officer to deal with you.

6. You shouldn’t make any payment to get financing

Legitimate loan companies don’t ask for money up front. One of the personal loan fraud’s modus operandi is to ask their victims to deposit some amount of money for certain costs. In fact, some agents even requested the borrower to deposit money into different bank accounts before ‘releasing’ the loan to the borrower in order to ‘process’ the loan.

In fact, there are few who pretended to be the agents/officers of the leading personal financing company, bank officers, Bank Negara Malaysia (BNM) officials and also members of the Royal Malaysian Police (PDRM) for the following purposes:

- To request a personal financing deposit before missing in action.

- To request personal information such as bank account information and credit card before applying for a personal loan. This technique is known as ‘spoofing’.

If you are dealing with the party that’s requesting payment before the loan is granted, it’s advisable not to proceed with the personal financing application of the company and immediately inform/highlight to the financier directly. For YIR and YYP, you may write to pertanyaan@yir.com.my and pertanyaan@yyp.com.my to log your complaint and to prevent other innocent customers from falling prey or being cheated by these unethical parties.

Be a wise borrower and consumer!

You are also advised to carefully understand and read the documents before signing it to avoid any unwanted predicaments.

We urge all customers to pay extra attention during Akad. An Akad is conducted to form confirmation and promise made between the customers and their respective Islamic financiers. During this process, you are required to answer the questions and confirm the financing details earnestly and carefully. This also presents an opportunity for you to clear all your concerns with the officer-in-charge (“OIC”) before confirming.

Additionally, some irresponsible agents may intentionally misguide you to serve their own selfish needs. Afterall, they are commission based. The higher the loan amount, the higher the commission earned. For example, they may advise you to agree to all the questions inquired by the OIC during Akad, putting you in future unfavorable positions while the agents make a quick buck. You are once again advised to utilize the opportunity to clarify with the OIC and agree only when you’re satisfied with the feedback provided. If there are any doubts and/or suspicions, please express your thoughts without hesitation to the OIC to safeguard your interests.

As a responsible Malaysian citizen, if you know individuals who apply for personal financing from a dubious party, share this article with them to avoid becoming one of the victims of fraud. In addition, to know if you are on the right track, we recommend you to make personal financing comparisons for FREE at Loanstreet.

If you work with a government body or GLCs, do know that you can get exclusive financial assistance from YIR or YYP for faster approval – within 2 working days. YIR or YYP are solely funded by RCE Marketing Sdn Bhd (“RCEM”) through a partnership agreement. RCEM is a subsidiary company of RCE Capital Berhad, an investment holding company incorporated in Malaysia and listed on the Main Market of Bursa Securities on 23 Aug 2006.

In addition, they also offer profit rates as low as 6.50% – 9.99 per annum depending on your credit scoring like the criteria required such as your payment history on loans and credit cards, total debt and the amount owed and length of credit history. The stronger your credit profile, the more attractive the profit rate to be offered to you. Conversely, the weaker your credit profile, the higher the profit rate to be offered.

In addition, they also offer profit rates as low as 6.50% – 9.99 per annum depending on your credit scoring like the criteria required such as your payment history on loans and credit cards, total debt and the amount owed and length of credit history. The stronger your credit profile, the more attractive the profit rate to be offered to you. Conversely, the weaker your credit profile, the higher the profit rate to be offered.